Sweet Deal or Sour Gamble? Unwrapping a Confectionary Turnaround

Highlights:

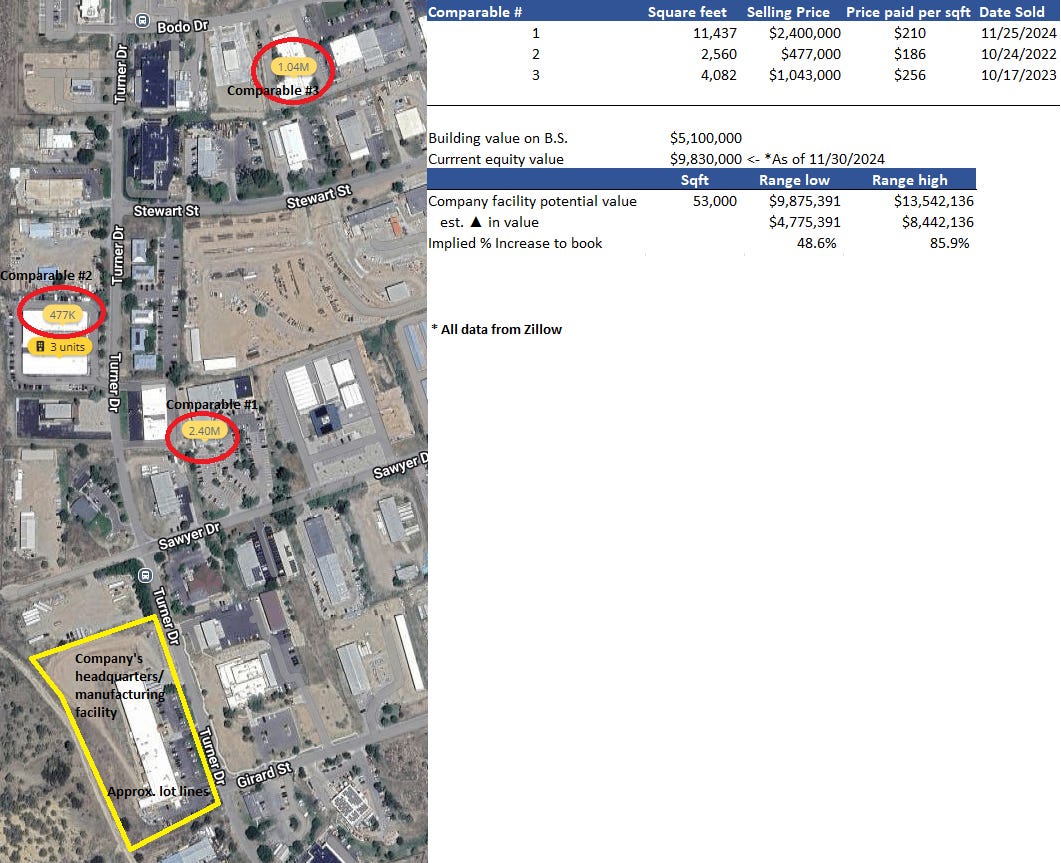

Management is selling off non-core brands/assets

Trading at 1x book

Value of main building estimated to be worth 2x the value on the balance sheet

This would increase equity value by 50%

Coming out of a costly proxy battle

Company Name / Ticker is below disclosure - please read

Introduction:

We all know the admiration Warren Buffett and Charlie Munger have/had for See’s Candies and how the economics of the business are superb. So, imagine my delight when I came across this depressed stock doing something similar. Though it is currently facing headwinds, it has operated for over 40 years and has had a fair quite a bit of success.

This is not a comprehensive deep dive into financials, history, etc. This is an overview of some of the main points I believe are relevant to the company and its current situation. This is meant for educational purposes and for you to decide if you want to dive deeper into analyzing this company - please see the disclaimer below.

Company Description:

The company is an international franchisor, confectionary producer, and retail operator. They were founded in 1981 and are headquartered in Colorado. The company currently has 2 company-owned, 115 licensee-owned, and 152 franchised stores.

How They Make Money:

The company earns a % of the gross monthly value of products sold by franchisees, from its own retail operations as well as selling goods to the franchisees.

Headwinds:

The company went through a tough time during COVID, an estimated 30 - 50 stores closed down and never reopened, they had to fight a multi-year proxy contest which cost them $4.1million in FY 2023 and $1.7 million in FY 2022, gross margins have compressed, and they have had 3 CEOs since 2020.

In 2024, the cost of cocoa soared from $4,160/ metric tonne at the beginning of the year to $10,980 by the end of the year. This would explain the deterioration of net margins last year and even in 2023, which started the year at $2,600/ton. Price per metric tonne now sits at around $7,900, down ~28% since the start of the year. The 2023/24 season saw a deficit of 462,00 - 478,000 tonnes driven by adverse weather, aging trees, and diseases affecting the trees. 70% of the world’s cocoa production comes from West Africa.

Recent Proxy-Fight:

In September 2021, AB Value Partners LP, along with related parties, filed a proxy statement asking shareholders of the company to vote for their board nominations as they believed the board was ineffective, reactive, not proactive, and had a poor history of execution. The company fought this proxy battle for

Sale of Non-Core Business:

On May 1, 2023, the company sold their U-Swirl business for $1.75 million in cash and a $1 million secured promissory note. It looks like the company acquired U-Swirl or at least the majority of shares of U-Swirl, after the company made a loan to U-Swirl, which violated the covenants of the loan and was subsequently “acquired” by the company we are talking about today.

Buyout Offers:

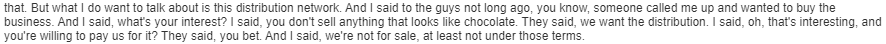

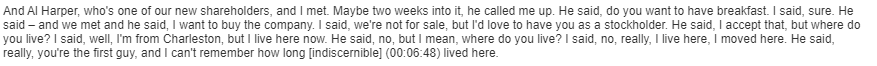

The current interim CEO & board member made comments during the 2024 investor meeting that there had been two offers to acquire the company. The first was from an undisclosed individual/company that wanted to buy the company for the distribution network. The second came from an individual who is local to the area in which the company is headquartered, stating that he knew exactly what he wanted to do with the company and had a business plan ready to go. The CEO stated that they were not for sale, and that individual became the second largest shareholder and serves on the board.

Source: 2024 investor day transcript

An Undervalued Asset:

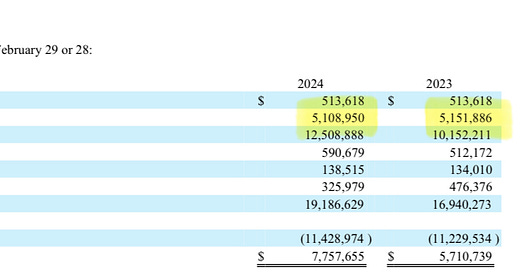

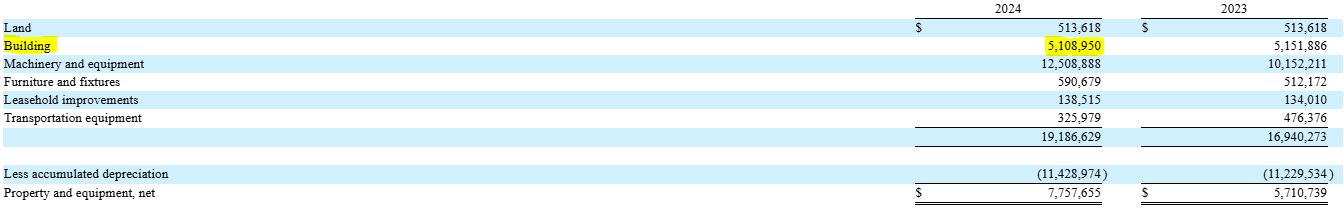

The company owns a 53,000 square foot manufacturing facility, which it carries on its books at $5.1 million. After a quick comparable analysis, it is in my opinion, worth 2x - 2.5x its value currently on the balance sheet. This would imply equity value is undervalued by nearly 50% to 85%.

Source: 2024 10-K

Stores:

The company has 2 company-owned stores, 115 licensee-owned and 152 franchised stores, some of which the company acts as the primary lessee and subleases to the franchisees, but a majority of the locations are leased by the franchisor directly.

Why I Think Things Are Looking Better:

In my opinion, if the company can continue to weather the inflated cocoa prices and see them return to a “normal level” along with improving online offerings, I think this could be a compelling company. If it becomes profitable again and returns to its policy of issuing a $0.48 dividend, then at its current price, that would represent a ~40% dividend yield and not even the price appreciation that could potentially result from a return to profitability.

Disclosure:

The content on this blog represents my personal opinions and ideas, not those of any employer, organization, or entity I may be affiliated with. I am not a financial advisor, and the information provided here is for educational and informational purposes only. Readers should conduct their own research and consult with qualified professionals before making any investment or financial decisions.

I, or individuals I know, may at any time own, buy, or sell shares or other financial instruments discussed in this report or on this blog without prior notification to readers. Any such actions are based on my own discretion and do not constitute a recommendation for others to follow. Investment decisions are inherently risky, and readers are encouraged to carefully consider their own financial situation and risk tolerance before acting on any information presented here.

Company Name & Ticker:

Rocky Mountain Chocolate Factory (RMCF)